Evidence to the Treasury Committee (January 2007)

I’m struggling to write something about housing, planning and climate change but I have just found some evidence I sent to the House of Commons Treasury Committee in 2007. Depressingly, I find it harder to write like this now.

Below, I used the term “continuing planning permission”. It would be better termed “property location right”. A property location right is the right to have a building on a particular plot of land.

In 2019, using numbers from the Office of National Statistics, I calculated that the total value of these property location rights was half of the UK national wealth. By incorporating these in the value of land, the ONS classifies these as a natural resource.

ONS, how can property location right be a natural resource?

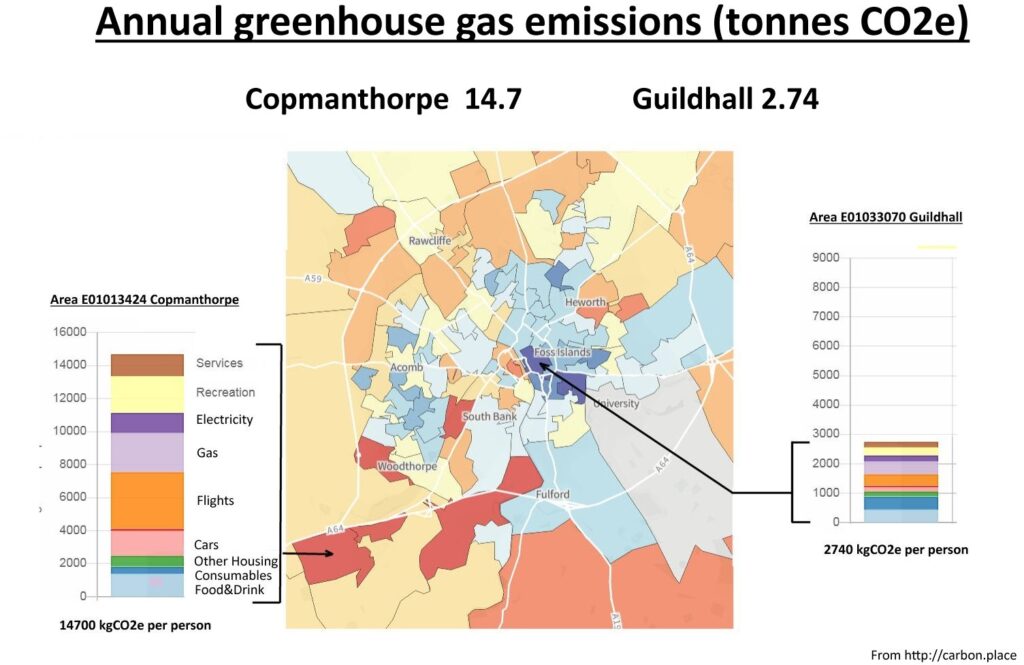

Since I wrote the evidence to the Treasury Committee, a very useful website has been published. It is carbon.place, which estimates the personal carbon emissions of residents by Lower Super Output Area. It shows that affluent car-based areas have emissions several times those of less affluent areas. (See image above)

Evidence to the Treasury Committee, January 2007

Climate change and the Stern review: the implications for HM Treasury policy on tax and the environment.

Taxation, planning and the environment

Executive summary

The UK generates a small percentage of the world’s CO2. The best role for the UK is to show the rest of the world that pleasant environmentally friendly lifestyles are possible. Economic mechanisms such as earmarked taxes are necessary but it will be necessary to go beyond purely economic disciplines.

Large budgets for education and promotion are necessary to gain public acceptance. So are large environmental lifestyle projects such as model settlements. The finance can be found within the planning system. It should be recognised that the planning system creates very large amounts of wealth, which can be traded on an international scale. It is possible that existing development corporation legislation can be used to this effect.

1. Environmental leadership means drastic changes in lifestyles

The UK generates a small percentage of the world’s CO2e, although, per capita, its citizens produce much more than the world average. The useful role that the UK can play is one of leadership to show the rest of the world that pleasant yet sustainable lifestyles are possible. Sustainable lifestyles might require a cut in the generation of CO2e of a factor of three or more. Technological advances may help but personal rationing of CO2e will be needed. If the personal allowance is to be set at the level currently thought to be necessary to achieve world sustainability significant changes in lifestyle will be inevitable. The Fishergate Environmental Panel is currently engaged in an assessment of a reasonable figure for a daily ration of the individual production of CO2e. The panel has accepted, for the time being, that 10 kg of CO2e per day (3.65 tonnes CO2e per year) is a target that fits with current thinking on climate change.

The panel is assessing the impact of everyday goods and services against this daily ration, for example; champagne, contained in a bottle weighing 1Kg, represents a day’s allowance. A return car journey from York to London is approximately two weeks’ allowance. A return flight from London to Melbourne is over three years’ allowance (this figure takes account of the fact that CO2 released in the upper atmosphere has three times the effect as CO2 released at ground level).

Showing that pleasant lifestyles are possible at such levels of CO2e ration is a challenge that will require the deployment of skills that go beyond those that can be provided by economists. It needs a new breed of planners who can fit their work into an economic framework by postulating practical models of lifestyles that are consistent with sustainability. To this end, they will require the skills of environmental scientists, sociologists, architects, transport planners in short, the whole gamut of specialisations that help to shape and control our society.

2. Earmarked taxes and campaigning needed for public acceptance.

Earmarked taxes, for well-meaning theoretical reasons, have often been deprecated by economists. But, in important cases, they have been used to gain public acceptance. The largest example in the UK is National Insurance, which is widely recognised as an earmarked tax. Another example is the National Lottery. It raises funds for “good causes” and has widespread acceptance. However, by certain cynics, it is called “The Stupidity Tax”. However, one typical lottery player, an intelligent person, says: “The tax on the lottery is generally a good thing, particularly when the money goes to good causes”.

With an earmarked tax there is greater scope for publicising the associated “good news” message. For example, it is part of the National Lottery’s pitch that it raises money for good works. One of the main barriers to environmental understanding is the size of advertising budgets promoting environmentally unfriendly products and services such as cars, air-travel and champagne. These budgets dwarf those for educational efforts by governments or NGOs. If those administering earmarked environmental taxes were able to explain the environmental benefits, using an appropriate promotional budget, there may be some redress.

In general, public acceptance of ‘green’ taxation will be easier if the link between tax and expenditure are conceptually linked or limited to a specific geographical locality. The following are examples of possible earmarked taxes:

a. Road tolls to subsidise local public transport (i).

b. A tax on supermarket car parks to give a turnover subsidy to local and high street shops (ii).

c. Air freight landing charge to finance environmentally friendly development projects (overseas and in the UK).

d. Progressive taxation of electricity, gas and oil consumption to subsidise building improvements (iii).

e. Taxation of primary energy, based on CO2e, to develop environmentally friendly energy sources(iv).

g. A tax on wine bottles and a cut in the tax on wine (v).

e. A tax on new construction to subsidise building conversion (vi).

Notes:

i. In 2003, a study by York Council calculated the impact of a £1 toll on three bridges in the centre of York, and concluded that it could cut through traffic substantially. The scheme would cost about £1 million to introduce, but raise £7 million in revenue. Such revenues could transform public transport in York.

ii. The means of subsidy needs careful design and testing. A subsidy on turnover is likely to be more effective since it encourages the shops to boost their activity so that more people walked to local shops or travelled on public transport or bicycles to the high street.

iii. In general, the affluent have a much larger carbon footprint than the poor. With larger houses to heat and more equipment to power, their use of energy within the home will be greater. One way of cutting fuel use in a way that avoids “fuel poverty” would to make an initial allocation of cheap fuel but increase the price as consumption rises. A more straightforward way would be to increase fuel prices and earmark the revenue as individual fuel allowances but this would be harder for the public to accept.

iv. Such taxation, properly enforced by government, could have greater public support than offset schemes which have come in for deserved criticism. In addition, consumers may feel that buying energy from “green” sources leaves cheaper “dirty” energy to be sold to someone else with no net environmental benefit.

v. It is not widely known that, when “recycled”, most green and brown bottles are not melted down to form new bottles. Many are used for hardcore under motorways. In any case, with clear glass bottles that are melted down to form new glass, only a fraction of the energy and CO2e is saved. The main driver for recycling bottles is to reduce the weight of rubbish going into landfill thus reducing landfill tax. Preventing an inert substance like glass entering landfill is a tiny environmental plus compared to the CO2e generated in bottle manufacture.

vi. The construction of new buildings causes considerable amounts of CO2e. Building a new house creates many tens of tons. The “capital CO2e” cost is often spread over the expected life of the building and then compared to the CO2e generated during the use of the building. This method is not correct. A discount rate should be used to account for changes in building technology or positive feedbacks in climate change. However, this topic is too large for this note.

3. The built environment determines sustainability and is a generator of wealth.

The built environment determines much of our sustainability. At home, workplace and holiday destination, we create large amounts of CO2e. Our journeys between these places create more. However, in the UK particularly, the built environment is a generator of enormous wealth not properly considered in traditional economics. Over little more than a decade property values in the UK have risen by £2 trillion. The most important factor in this rise has been the supply of planning permission.

It is possible to separate two factors that comprise the value of property. These factors are the value of the structure and the value of the “continuing” planning permission. “Continuing planning permission” means the right to keep a particular structure in a particular place. For most of the property in the UK, continued planning permission over the land on which it is situated is more valuable than the replacement costs of the bricks, mortar and labour by which it is built (note 3a). It is the increase in value of this scarce commodity, planning permission, which has put two GDPs of wealth into the UK economy in little more than a decade.

It is the planning system in the UK that restricts the supply of buildings and other developments. This makes existing buildings as well as new developments more valuable. This wealth has not been fairly shared; it lies at the disposal of property owners. It is spent by people who inherit property, people who downsize and by the multitudes that are able to borrow against the value of this serendipitous form of wealth generation.

Many property owners deny that they are benefiting from these increases in value and, of course, they may not benefit: The value may be realised after their death. This means that property taxes are difficult for politicians to sell to their voters.

A planning gain supplement is one tool for recouping for society some of the wealth generated by a restricted supply of planning permission. It has the advantage that the public perceives planning gain as an undeserved windfall. But this tax has two drawbacks. First, developers might postpone new building in anticipation of a change in the legislation that would give them a more profitable business climate. Secondly, it does nothing to address price changes within the pool of existing property. A planning gain supplement needs other mechanisms in its support.

4. Funding environmental projects using the wealth from planning permission.

A proposal that is worthy of further investigation is to use the wealth generated by the planning system to fund environmental and social projects. This would enable the UK to fund projects which would be an example to the rest of the world. This may be achieved using existing legislation on development corporations.

Guidelines:

a. Despite the unfair transfer of wealth that the planning system has engendered, it would be foolhardy to allow a substantial fall in property values. The example of Japan in the 1990s shows the economic damage that this can cause.

b. House prices should be stabilised throughout the country. This means adjusting the supply of planning permission in any particular area to control property prices. Statutory bodies should be created whose remit should be to create a steady flow of planning permission to achieve price stability, ideally without the use of compulsory purchase. The MPC may be seen as a model for this.

c. Statutory bodies could simply sell planning permission to suitable bidders or they might buy suitable land (or other development opportunities) and give themselves planning permission before selling them on, thus capturing planning permission wealth for the community.

d. The some of the wealth captured by these mechanisms should be earmarked for the development of sustainable lifestyles. Few people notice that something of this nature already happens. For example, in York, both all three institutions of higher and further education (York Colleges, the University of York St John and the University of York) are benefiting from the grant of planning permission to build houses and offices worth many tens of millions of pounds. These wealth generated by these grants of planning permission go largely unnoticed. In my view they have the nature of a stealth earmarked tax, earmarked for education.

e. The statutory bodies should use a proportion of the wealth they create to fund advances in sustainable technologies and sustainable communities. Since few people notice the wealth generated by the grant of planning permission, the objections to such expenditure would be limited.

f. In a few cases, such as London, it may be that there is limited opportunity for the expansion that the grant of planning permission implies. In such cases it may be possible for these statutory bodies to fund relocation and transport links, following the model of the Metropolitan Railway in the 19th century.

5. Existing development corporation legislation, a possible mechanism

It may be possible that the statutory bodies mentioned above could be set up using existing development corporation legislation.

New development corporations (note 5a) might be created, which would have the power to grant planning permission over significantly larger areas than they intend to develop. This would enable the corporations to buy up land before definitely identifying where planning permission is to be granted. Thus land could be bought at or near agricultural prices. The value of the planning permission could then be captured by the development corporations on behalf of society with little or no use of compulsory purchase.

6. The good life; a source of wealth.

We have a country that, for many, is a pleasant and safe place in which to live and, in urban areas in particular, that offers plentiful employment (albeit that much of this is low paid and insecure work within service industries). These benefits are reflected in the demand for property. Towns and cities that are attractive have experienced the highest rates of increase in property values. This is not simply a tautological and self-evident truth. The factors that contribute to “attractiveness” can be estimated independently from the value that they add to property stock. In addition, it is likely that impending environmental change will leave this country with a relatively benign climate. If a mechanism were to exist that could develop the U.K. as a leader in the provision of environmentally friendly and sustainable communities its attractiveness in a world that is beset with insecurity, fear and actual environmental degradation would be assured.

7. Planning permission is an internationally tradable commodity.

If it is to be viewed as a commodity at all, planning permission would appear to be one, which cannot be traded across international borders. But “continuing” planning permission (note 7a), embodied in property, can be sold or rented to foreign nationals as migrants or visitors. The UK has only about 10% of its land area developed and in many cases existing developed land could be developed more intensively. Consequently, given the factors set out in paragraph 8, we have a large store of a valuable commodity. We should husband it wisely (note 7b).

8. Planning sustainable communities.

The wise husbandry of the commodity represented by planning permission would not be achieved were it simply to be used to create the kind of unsustainable development that currently blights much of our new build. The primary concern for the statutory bodies that we propose would be to ensure that all new schemes have as their first planning criterion, the need to produce radical solutions for environmental sustainability. The factors that make our region attractive to settlers must be nurtured and of these the provision of an environment that is relatively secure from future degradation is the most precious. An opportunity exists to create a haven within our region. This is not simply an expression of Utopian green thinking but an economic necessity. As our manufacturing industries decline it would make sense to view our islands and their social and physical infrastructure as a wealth generating resource. To do this we must focus on creating an environment that will offer security in the face of the turmoil that will follow the change in global conditions consequent upon predicted climate change.

9. Model settlements.

There is an opportunity for using planning wealth to develop model settlements, in which it will be possible to live comfortably as a sustainable human. Whilst there are pioneering examples of settlements designed to attain sustainability like Findhorn (note 9a) or Bedzed (note 9b), a wide range of radical examples is needed to show the world that worthwhile sustainable lifestyles are possible. It should be pointed out that neither of these two model settlements yet achieves a sustainable lifestyle (note 9c).

Notes:

3a. A simple example shows this: Imagine a building that falls off a cliff in circumstances where the problem was not anticipated and the threat not reflected in its market value. If the owners had movable planning permission that allowed them to build on any land they could buy within 10 kilometres, they would lose a fraction of the value of the doomed building.

5a. As an example, a corporation with the remit to develop, say, three percent of the area within 20 kms of York would be in a position to purchase between 3000 and 4000 hectares of land. It would ask for offers from landowners who wished to sell suitable land. Informal enquiries of farmers in the York area suggest that some farmers would sell land at less than twice agricultural prices. The development corporation would own the most valuable asset, the planning permission, and could capture its value on behalf of society.

7a. This is the sum of historically granted planning permission including permission that has been granted by default.

7b. This commodity is already traded internationally. UK nationals have sold houses in order to emigrate to farms in France whilst Polish workers have come here to rent property. Expensive parts of London have apartments bought as holiday homes for wealthy people from many countries. We should perhaps learn from the way in which De Beers controls the diamond market.

9a. Findhorn, see http://www.ecovillagefindhorn.com

9b. Bedzed, see http://www.peabody.org.uk/pages/GetPage.aspx?id=179

9c. One measure of sustainable lifestyle is ecological footprint measured in “global hectares”. A sustainable human would have a foot print of 1.9 hectares. Findhorn’s residents claim they have reduced their footprint to “2.78 hectares, a little over half the UK national average (5.4 hectares)”, which is the lowest footprint in the industrialised world and “13% lower than those at the London eco-housing development, BedZED.”