Getting Britain back to work (1982)

This is old article I had published in the Guardian back in 1982.

Later Professor Kim Swales and I did a report for

the European Commission with improved modelling.

(Now we that know the dangers of climate change, a carbon tax

may be a better solution than VAT for the tax in this scheme.)

DURING the last period of mass unemployment in the 1930s, some economists, not ably Lord Kaldor considered the possibility of subsidising the labour of all workers to create jobs. His idea assumes that labour is like other commodities in that if its costs can be reduced then the demand for it should increase.

Since then, there has been little interest in such large scale subsidy policies. This may be because “back-of-the-envelope” estimates show that the cost of such schemes is enormous. These estimates however may not be as conclusive as they at first seem. A model of Britain’s economy can be described which, although only approximation shows that large scale labour subsidies can be an important ingredient in a policy to significantly reduce unemployment.

Most of the “back-of-the-envelope” estimates that are occasionally published are based on a model of the economy that has only two sectors: capital and labour. In such a two~sector model there is only one obvious source of finance for labour subsidies, a tax on capital. However, in Britain the labour sector is about 70 per cent of the economy and the capital sector only 30 per cent. It soon becomes clear that the capital sector is too small to generate enough finance to subsidise the labour sector to the extent of having a significant effect on employment levels.

In the context of a labour subsidy policy, however, a model of the economy in which there is only one labour sector misses one of the most important features of unemployment: most of the unemployed come from low-paid occupations. So while schemes which subsidise all labour equally are not likely to be successful those which aim the subsidy at the lower-paid sectors appear more hopeful.

One such scheme would replace the present Value Added Tax by a combined tax and subsidy. In this scheme, an enterprise would pay a much higher basic rate of tax (e.g. 50 per cent instead of the present rate of 15 per cent) but would receive a subsidy for each worker it employed (eg. £40 per worker per week). This would mean that an enterprise employing mostly low-paid labour would receive a net subsidy, while enterprises employing mostly capital and high-paid labour would bear a much heavier tax than at present.

To get an approximate estimate of the effect of such policies, a small computer programme has been designed, based on a simple model of the economy with five labour sectors. The programme ensures that the tax and subsidy scheme is self financing, balancing the subsidy paid out against extra taxes collected. plus the savings made by the exchequer when extra employment is created. These savings include unemployment benefit which is no longer paid when someone ceases to be unemployed, plus the extra taxes which are collected when a worker is in employment. The savings are estimated at 70 per cent of the working wage.

The model on which the programme is based uses money values which have been slightly out-dated by inflation. They can easily be up-dated to present values by a simple percentage increase. Britain has 25 million workers, with three million unemployed.

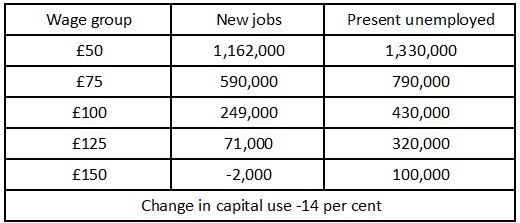

For this model, the labour sector is divided into five groups of five million workers. whose weekly earnings are £50, £75, £100, £125and £150 (based on the New Earnings Survey 1977). Most unemployment is amongst those in the £50 and £75 groups. Indeed, the unemployed in the higher-paid groups are often managers and professionals who have retired early.

In order to predict changes in demand for capital and labour from changes in taxes and subsidies, some estimates of what economists call elasticities of substitution are needed. These elasticities have been estimated for the model by comparison with those from the better-known two-sector models. With the main ingredients of the model set, it is possible to give some of its results. One run of the computer programme with the basic rate of VAT set to 53 per cent and a labour subsidy of £40 per worker per week shows over two million jobs created. How these are distributed amongst the different wage groups is shown with an estimate of the present number unemployed (see table below).

Even given the approximations of the model used and the drastic effect on capital use, the large impact on unemployment surely makes policies of this type worthy of further consideration.

It is perhaps also worth saying something about the effect on prices in the shops. Clearly those goods and services provided mostly by the lower—paid sector (e.g. catering services, public transport, clothing) will fall in price. Those made with little labour or high-paid labour (e.g. petrol, plastics. computer software) will rise in price. It should be noted, however. That average prices should fall because the value of the subsidy is larger then the increase in tax, the difference being made up by that falling unemployment produces.