Planning gain in the York Local Plan

Note, August 2022:

Between 2018 and 2022, the UK House Price Index, compiled by the Land Registry, has risen from 115 to 150 – an increase of 30%. The UK HPI is a measure of house price rises in the UK. This means the estimates of planning gain below are underestimates. Now, it is reasonable to say:

In York, an area of agricultural land big enough for a house has a value of less than £700. This increases to around £200,000 when planning permission is given to locate a house on the plot.

Planning gain in the York Local Plan

The estimates below suggest the total planning gain is

equal to 30 years of the council tax that York collects.

It’s not paid to York citizens, it goes to lucky landowners.

The £2.5 billion is enough to build 10 new large hospitals

or 150 secondary schools, with 1,000 pupils each

— or even 10,000 new Bentley’s for the Lord Mayor

Planning gain is the difference in the value of undeveloped land without planning permission and the value of the land after planning permission is granted.

This difference is very large in places like York where demand for building is high. The increase the value of land gives the landowner a windfall profit – before any building starts.

Here are two estimates of the total planning gain in the current version of York Local Plan.

Planning gain estimate 1 : £2.24 billion

The crudest way of estimating the planning gain is to look at the price of a new house where house prices are lower, like Bradford, compared to places where prices are high, like York. Today, Zoopla lists new 3 bedroomed houses in Bradford starting just about £100,000 and in York prices start about £250,000. The cost of building a house in York is the same as Bradford: Planning gain of £150,000 per house accounts for the difference.

The number of new dwellings in the York Local Plan is 14,940. This gives an estimate of £2.24 billion for the York Local Plan. That’s over twenty times the budget of York City Council.

Planning gain estimate 2: £2.55 billion

To make an alternative estimate of planning gain, I use the relationship

Planning gain = Selling price – development cost – agricultural land price

Here, I will use a value of £900 per square meter for building cost. This is from The City of York Local Plan Viability Study (2014) by Peter Brett and Associates (PBA). This is only slightly higher than RICS data for the Yorkshire and the Humber Region.

The PBA figure gives the building cost of a new house with floor area of 85 square metres (m2) in the as £76,500 but other costs should be added: external works (10%), professional fees (10%) and contingency (5%). This becomes £100,500.

Adding further sums for financing (7%), developers profit (20%), site purchaser’s costs (6.5%) and marketing (10%) makes the development cost of a notional house of 85m2 to be £133,875.

Agricultural land in Yorkshire has been valued at £21,000 per hectare. At a density of 35 dwellings per hectare(dph) this is £600 per house. Adding a possibly generous £5,000 for the Community Infrastructure Levy (CIL), £140,000 shold be subtracted from the sale price of a house to arrive at an estimate of planning gain. This gives

Planning gain = Selling price – £140,000

An indication of selling prices for new build green field 3 bedroomed houses with 85 m2 of floor space may be made in comparison with the new Development in Derwenthorpe. A typical example (82m2) is now selling for £322,000. So for a greenfield site, where little site remediation is required

Planning gain for one house = £322,000 – £140,000 = £182, 000

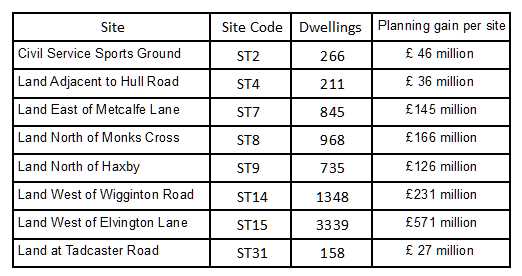

In making following calculations I have divided sites into greenfield sites and brownfield sites and use the percentages for affordable housing for greenfield (30%) and brownfield sites (20%). The following sites I have guessed as greenfield: st2, st4, st7, st8, st9, st14, st15, st31. The rest are brownfield.

Planning gain for greenfield sites

My estimates of planning gain for greenfield sites in the York Local Plan

Total planning gain for greenfield sites is £1.34 billion for 7870 dwellings. In terms of the population of York, this equals over £16,000 for each of the 83,000 or so households in York.

Planning gain for brownfield sites

For brownfield sites I have assumed/guessed an average value of £4,000 per dwelling for site remediation. At a density of 50 dph this is £200,000 per hectare. On the more polluted sites such as York Central, densities are planned to be 100 dph allowing £400,000 per hectare for remediation.

This gives the total planning gain for brownfield sites as £1.20 billion for 7070 dwellings. This is eqaul to more than £14,000 for each of the 83,000 or so households in York.

The combined total of planning gain is 30 years of council tax payments.

With the gain from greenfield developments, my second estimate of total planning gain in York is £2.55 billion equal to £30,000 for every household in York.

The report to City of York’s Budget Council 23 February 2017 says in the section Revenue Budget

40. Executive recommends that Council;

i. Approve the budget proposals outlined in the Financial Strategy

report and in particular;

a. The net revenue expenditure requirement of £119.659m

b. A council tax requirement of £81.630m

Using my two estimates, the planning gain in the York Local Plan is about 20 years of ‘net revenue expenditure’. (Estimate 1 gives 19 years. Estimate 2 gives 21 years.)

Similarly the estimates are about 30 years of York residents council tax. (Estimate 1 gives 27 years. Estimate 2 gives 31 years.)